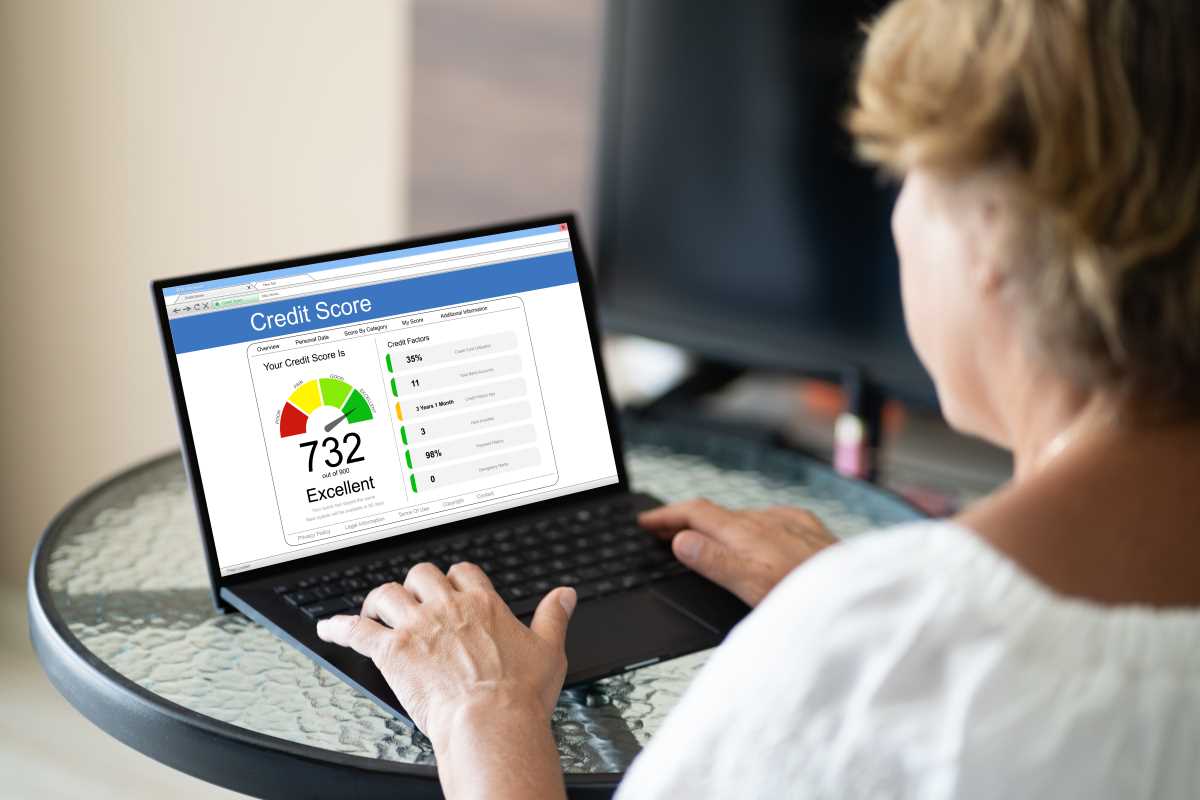

Understanding credit scores can lead to better loan offers and more attractive financial opportunities. A strong credit score often serves as a key that unlocks lower interest rates and an easier path to major purchases, such as a home or car. When you know how credit scores work, you gain confidence in making important financial decisions and protecting your future. This guide explores several often-overlooked methods for improving your credit score, breaking down the process into straightforward actions you can begin right away. With the right approach, building a healthier credit profile becomes simpler and more achievable than you might expect.

Improving your credit score quickly is all about taking focused actions that can make a difference. We break down everything from checking your credit report for surprises to asking for a credit limit increase, making it easier for you to master the process and see results fast.

Understanding Your Credit Report

Your credit report holds a wealth of information about your financial history. It tells the story of your borrowing habits and helps lenders decide on your creditworthiness. Knowing what to look for in your report can help you spot mistakes and opportunities to improve your score.

When you examine your credit report, make sure to check these key areas:

- Personal information for any inaccuracies

- Account status and payment history

- Outstanding balances and credit limits

- Recent inquiries that may affect your score

- Public records and any discrepancies

Strategy 1: Rapidly Dispute Errors

One way to give your credit score a quick boost is by identifying and disputing errors on your report. A mistake in your credit history can drag your score down, so act fast to correct these oversights. This process can often lead to a noticeable improvement in your score.

Follow these simple steps to challenge any inaccuracy you find:

- Obtain a copy of your credit report from the major credit bureaus.

- Review every section carefully, looking for mistakes or outdated details.

- Gather any supporting documents that prove your case.

- Submit a dispute with the credit bureau using their online platform or mail.

- Follow up on your dispute and keep records of all communication.

Strategy 2: Optimize Your Credit Utilization

Your credit utilization ratio, which is the percentage of your available credit that you’re using, plays a big role in your overall score. Keeping this ratio low can signal to lenders that you use your credit responsibly. Even small adjustments can make a noticeable impact quickly.

Consider these practical tips to manage your credit utilization:

- Pay off small balances first to lower your overall ratio.

- Aim to keep your credit usage below 30% of each card’s limit.

- Make multiple payments in a month if possible.

- Assess your spending habits and trim back on unnecessary charges.

Strategy 3: Become an Authorized User

If you have a family member or a trusted friend with a strong credit history, ask to be added as an authorized user on one of their credit cards. This move can help improve your score. It allows you to benefit from their good credit behavior without taking responsibility for repaying the debt.

The process involves asking the person if they are willing to let you use their card. Once added, this positive credit activity appears on your report and can help boost your score. Just make sure that the primary cardholder keeps a low balance and pays on time.

Strategy 4: Use debt consolidation Wisely

Debt consolidation can significantly improve your financial situation if you handle it properly. Combining multiple high-interest debts into one lower-rate loan helps you simplify your payments and save money on interest. This approach works especially well if you have several bills and need a clear plan to manage them.

Be careful when choosing this option. Make sure you understand the terms of the consolidation loan and evaluate if it truly benefits your overall financial health. A low-interest consolidation offer can quickly improve your credit standing.

Strategy 5: Request Higher Credit Limits

Increasing your credit limit can lower your credit utilization, and many lenders will consider your request if you have a good payment history. When you receive a higher limit, your current spending becomes a smaller percentage of your available credit, which can boost your score.

Keep these tips in mind when you ask for an increase:

- Show a history of responsible credit use.

- Regularly check your credit report before making the request.

- Avoid applying for multiple credit limit increases on different cards at once.

- Be cautious not to overspend just because your limit has increased.

Focus on one area at a time to understand your situation and make meaningful improvements. Begin with a simple step, such as reviewing your report, and build gradually. Consistent action can improve your financial opportunities.